OAPay’s Open Banking Feature is Redefining Money Movement Worldwide

Over the past decade, robust digitization in the financial services space and changing customer preferences have reshaped international money transfers. Open banking, in particular, is fundamentally changing how cross-border transfers work and enabling an all-around upgraded payment experience.

As per a recent report, open banking users are projected to increase by over 250%, surpassing 645 million by 2029. The rising confidence in open banking systems is believed to widen access to innovative financial services for millions of people.

In this article, we will understand how open banking unlocks new and improved remittance services. We will also explore how OAPay’s advanced open banking feature enables secure access to financial data and makes money move faster and more conveniently to Africa.

First up, what is the hype about open banking?

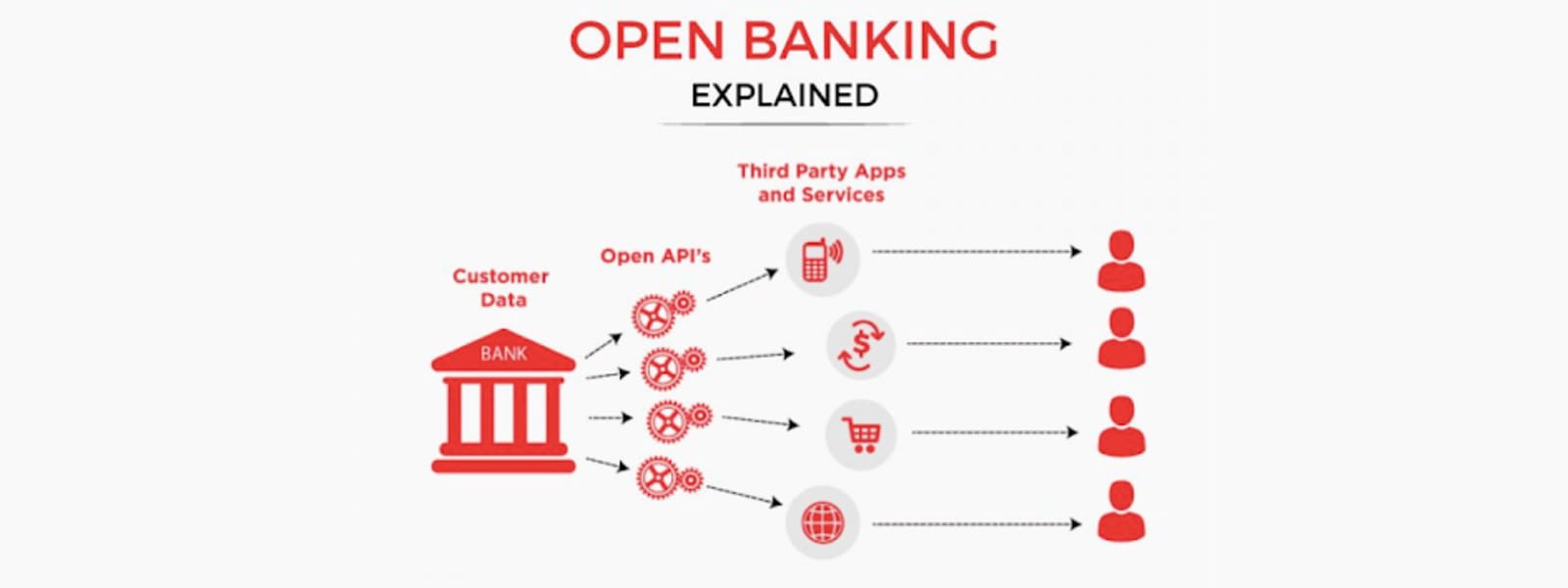

Open banking is transforming global financial infrastructure by enabling regulated third-party providers to securely access your financial account data (with your consent, of course) through Application Programming Interfaces (APIs).

Traditionally, only your bank could access your financial data. Open banking now empowers you to share that data with another financial service provider and use it for your own benefit.

While sending money across borders has always meant slow-moving transactions, unreliable exchange rates, and hidden fees—remittance apps like OAPay are putting the power back in the hands of the users with open banking.

Within the open banking infrastructure, users can share and validate their bank details more easily, resulting in reduced errors and delays while sending money. This means money transfer providers like OAPay can access your financial account information directly, without going through legacy rails or expensive intermediaries.

How is OAPay reimagining international money transfers with open banking?

Supported by regulations like PSD2, open banking is changing the way financial data moves. More users are choosing open banking over card payments for online money transfers to Africa.

Unlike traditional card-based methods, open banking offers a faster, more direct way to send money internationally, eliminating intermediaries that often cause delays.

OAPay’s Open Banking feature is taking things up several notches. Here’s how we’re leveraging open banking APIs to:

- Auto-fill your payment details

- You are then taken directly to your bank’s secure login

- All you need to do is authenticate using biometrics or your PIN

- And your payment to your loved ones in Africa is confirmed instantly

But what's in it for you?

- Cut out the intermediaries and send money straight from your bank account

- Enjoy near-instant transactions with real-time account checks

- Benefit from the industry-best exchange rates and zero hidden fees

At the forefront of the open banking revolution, OAPay is setting high standards with every online money transfer. We’re not just backing you up with unbeatable exchange rates and faster settlements, but we’re enabling greater financial confidence across emerging markets with our suite of financial tools.

Experience the power of open banking at your fingertips

Before open banking came into the picture, sending money home would require you to go to your bank, pay a transfer fee and an exchange rate (with no clear breakdown), and wait anywhere from 3 to 5 days for your recipient to receive the funds.

OAPay has switched up this model. Powered by open banking payments, we pull up your account details, initiate the transfer in seconds, and give you the best exchange rate, all in a fully regulated, safe and secure environment.

The best part? We take zero cuts from the transfer amount. Send more, spend less. Sign up with OAPay today!