How OAPay Is Powering Ghana’s Diaspora Economy, One Transfer at a Time

Over the years, the African diaspora has been effectively channeling its resources and expertise to drive sustainable wealth for the continent. From remittances to investments and job creation, members of the diaspora economy have been instrumental in fostering opportunities for prosperity.

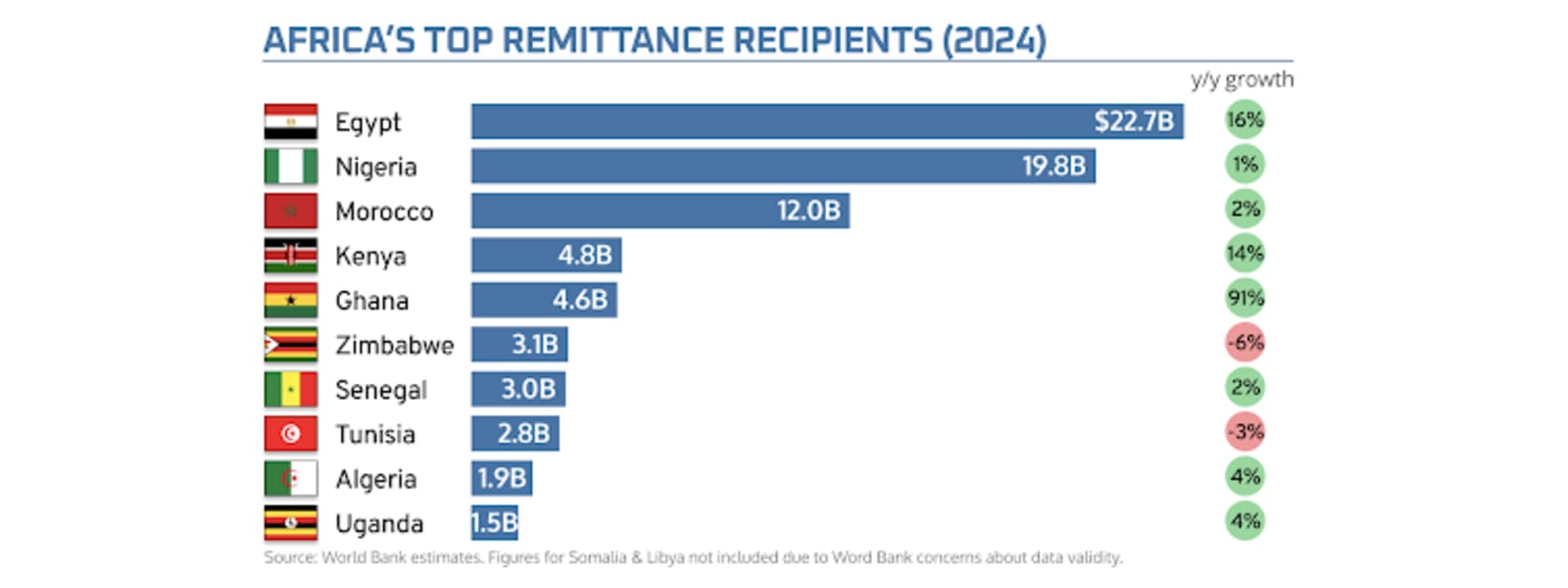

If you look at the numbers, remittance has become one of the most vital tools for uplifting the economies of countries like Ghana. Among the most notable developments in recent times is the remittances to Ghana rising by a whopping 91% to reach US$4.6 billion.

As Africa’s trusted money transfer application, OAPay is proud to play an integral part in powering the growth in remittances to Ghana and stabilizing the nation’s financial health. Every transfer matters, and we ensure we treat it that way.

This article breaks down how remittances are shaping Ghana’s growth story. We are also covering how OAPay contributes to this with strong compliance and a frictionless experience for both senders and recipients.

A closer look at Ghana’s remittance boom

Remittances to Africa are reportedly a $100 billion opportunity. In Ghana, the surge in inflows has helped drive inclusive growth and ensure financial security for millions of its citizens. It helps build resilience to withstand and recover from unforeseen economic shocks.

Ghana has a long history of migration, and in support of this, the government of Ghana has taken clear measures to boost the relationship between the homeland and its diaspora.

The rise in contributions from the Ghanaian diaspora is not by chance. It is the result of government initiatives that promote formal routes for remittances, coupled with regulatory oversight that builds trust.

On the ground, remittance providers like OAPay are making the entire process of transferring funds home a breeze. The combined efforts have helped reduce reliance on informal transfer routes, increase transparency, and build confidence among senders.

OAPay is built for today’s remittance reality

With strong roots in Ghana, our founders have experienced how clunky, fee-ridden transfer systems have made it stressful for individuals and businesses to send money internationally.

OAPay was built to help you realize dreams beyond borders. With an entire suite of powerful money transfer functionalities, a growing stack of financial tools, and a reliable customer support team, we make hassle-free international fund transfers a reality.

At OAPay, we have made a promise of trust to the African diaspora. Our services are built to complement government-led initiatives by focusing on key essentials like:

- Reliability: Our quick settlement times and the best exchange rates ensure your money arrives where it matters most, when it matters most.

- Trust: As a licensed and regulated provider, we are aligned with compliance standards that safeguard both senders and recipients.

- Transparency: Fees and exchange rates are displayed upfront, so there are no surprises.

- User experience: As a one-stop remittance platform with the highest standards of security, OAPay helps you transfer funds as effortlessly as possible from the US and the UK to Ghana, Nigeria, Kenya, Uganda, and Tanzania.

Building a trusted path forward for the diaspora economy

Strong oversight and exceptional services from cash transfer apps like OAPay translate to peace of mind for the diaspora economy. Transfers are now more predictable with lower risks of unexpected delays or missing funds. Recipients back home can receive money faster with on-time settlements.

As remittances continue to play a defining role in countries like Ghana, we at OAPay are happy to be a part of this journey, empowering African immigrants to send funds responsibly and fuel progress for all.

Wherever life takes you, OAPay makes sending and receiving money at home feel simple. Sign up today on OAPay.

FAQs:

1. Why are remittances key to Ghana's growth?

While diaspora economy transfers funds to support households with everyday expenses, they also contribute to investments in education and small businesses, aiding the broader development of the nation.

2. Is OAPay licensed and compliant?

Yes, OAPay adheres to strict compliance standards and operates under licensing frameworks in the UK, like FCA and HMRC, and in the US, we’re backed by FinCEN and a Money Transmitter license in various states. These regulations ensure we keep both senders and recipients safe from fraud.

3. How can I start using OAPay?

It's simple: all you need to do is sign up here, create your account, and complete a quick verification process. Once you are all set, you can send money safely and instantly to your loved ones in Ghana, Nigeria, Kenya, Uganda, and Tanzania.