From Bulk Payouts to Higher Thresholds, OAPay Powers Business Momentum in Africa with Real-Time Settlements

The "out-of-Africa" migration has only proliferated over the years. With the employment of foreign-born workers going strong in the UK and the US, diaspora remittances continue to be a steadily growing pillar of the continent’s financial inflows.

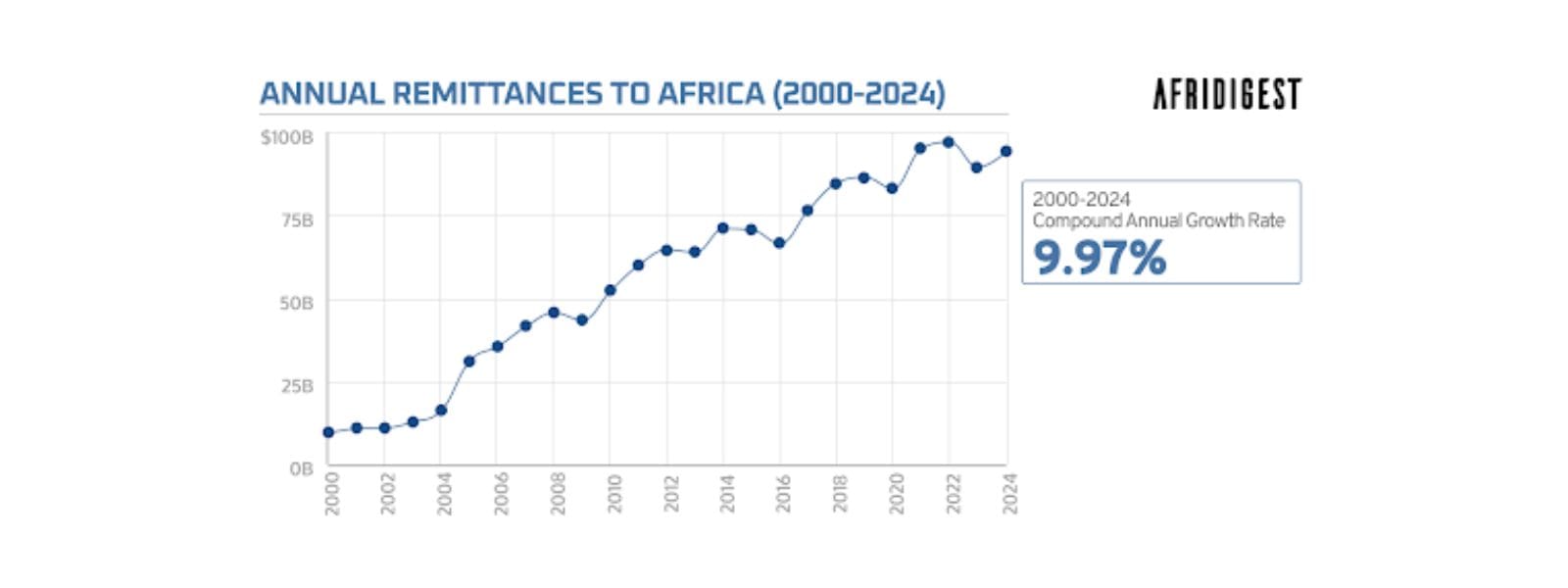

Owing to the increasing scale and stability of remittance inflows to Africa, its macroeconomic significance is also on the rise. Currently, Africa receives close to $100 billion in annual remittances, a number that is growing at around a 10% long-term Compound Annual Growth Rate (CAGR).

Undoubtedly, remittances have emerged as one of Africa’s largest and most stable sources of external finance, helping strengthen national reserves and ease economic vulnerabilities.

International businesses and entrepreneurs are also starting to take notice of the impressive scale and potential of Africa’s remittance market. However, hidden costs and inefficiencies of manual reconciliations plague business-to-business international money transfers to Africa. That's where OAPay comes into the picture.

As B2B cross-border payments are shifting toward real-time orchestration, OAPay has become the preferred partner for businesses in the UK and the US to move money internationally. In this article, we tell you how OAPay is delivering exceptional speed, scale, and control in transferring money to business accounts in Africa.

How businesses can capture value from Africa’s remittance boom

By 2035, Africa’s cross-border payments market is set to triple, surpassing USD 1 trillion. For businesses, this brings new opportunities to deepen supplier relationships, unlock new trade partnerships, ease payroll execution, and improve capital efficiency across the continent.

Global businesses looking to tap into new customer bases in Africa are often faced with bottlenecks in international transfers that slow down operations and spike up costs.

Businesses looking to send international transfers need to tackle challenges like:

- Foreign exchange markups add hidden costs that cut into margins

- International bank transfers remain a costly option, with an average cost of 14.55%

- Manual processes extend reconciliation timelines, tying up critical working capital for businesses

- Compliance requirements further delay transaction approvals

Against this backdrop, what businesses need today is to partner with transfer service providers that can match the pace of global business. OAPay balances speed with security, making it a trusted international money transfer app tailored for corporate needs.

OAPay’s product suite is tailored for global businesses

For businesses of today, speed and reliability are non-negotiable. Keeping this in mind, we have purpose-built OAPay for scaling money transfers to Africa.

Backed by an end-to-end product suite, OAPay offers best-in-class B2B payment features like bulk payment orchestration, higher transaction limits, integrated reconciliation, and multi-user controls.

OAPay addresses both operational and compliance complexities head-on. By taking a business-first approach and topping it off with our enterprise-grade platform, our B2B payment solutions are designed to help businesses in the UK and the US send money to Africa without delays.

From paying employees to settling procurement contracts, here's how OAPay is building trust in international business transfers to Africa.

1. Corporate portal for bulk payments

OAPay offers a dedicated portal for corporates. For businesses handling large transfers, they can send salaries, supplier payments, or trade settlements in bulk through a single corporate portal. With our centralized platform, you can also give your finance teams greater visibility and control by keeping approval processes consolidated in one place.

2. Higher thresholds for enterprise needs

As businesses grow, so do their payment needs. We offer higher thresholds compared to personal accounts, enabling businesses of all sizes to move larger amounts to Africa without the operational bottlenecks. We support large-scale business transfers, such as procurement orders, investment inflows, or treasury settlements.

3. Smart invoicing and reconciliation

We have seen how most businesses face hurdles in aligning international business transfers with their accounting records. Our smart invoicing tools are designed to easily reconcile payments with supplier or employee records and integrate smoothly with your existing tech stack and finance workflows.

4. Role-based workflow for accountability

Businesses using OAPay benefit from our multi-user workflows with role-based access. You can set up sub-accounts for team members and create a clear structure and audit trail by assigning roles to finance, compliance, and admin.

5. Priority onboarding and SLA-backed APIs

For businesses entering new markets, speed is critical. What OAPay brings to the table is priority onboarding, faster KYC, and SLA-based response times. If needed, we also offer API access to facilitate programmatic payouts for regular salaries, vendor payments, and automated sanction checks.

Move money to Africa at the speed of business

The OAPay platform is custom-built for businesses looking to step into new frontiers globally. If yours is a business looking to scale across borders, our corporate-grade product suite, packed with market-leading exchange rates and zero commission fees, is ideal for global operations.

We ensure every transfer into Africa will be executed with speed and precision, helping businesses reduce costs while keeping operations lean and compliant.

Experience last-mile payout success for all your international business transfers with OAPay. Sign up here.

FAQs:

1. How can a trusted money transfer partner help my business reduce costs and increase efficiency?

A trusted money transfer partner like OAPay centralizes international payments, has no hidden charges, and offers the best-in-market exchange rates. With transparent pricing and automation built into the platform, they lower costs and reduce administrative overheads, ensuring business payments arrive on time.

2. What should I look for in a money transfer partner for my business?

Apart from choosing a money transfer app with upfront fee disclosure and competitive exchange rates, you also need to look for:

- Scalability to support small recurring transfers and large payouts cost-effectively

- Real-time visibility into transactions and approvals

- A robust compliance framework for safe cross-border transfers

- Smooth integration with your existing finance systems and tech stack

3. Why is speed so important for business money transfers to and from Africa?

We operate in fast-moving markets where slow transfers mean missed opportunities. While late salary disbursements impact employee morale, a delay in supplier payments can halt shipments. Moreover, currency values shift within hours, and the change in value can erode your margins if funds are stuck in transit. Faster international business transfers lock in favorable exchange rates, ensure that projects are uninterrupted, and keep relationships with stakeholders strong.